Strategically managing your dividends is crucial for your financial goals, even if it feels a bit complex. As a small business owner, understanding the basics of franked and unfranked dividends is key to developing better tax strategies.

In various business and investment scenarios, not only small business owners but also individuals can gain a tax advantage through the strategic use of franking credits.

At Blackwattle Tax, we recommend consulting a qualified professional, such as a Chartered Accountant or Registered Tax Agent, to help you navigate these complexities. After all, if not properly applied, it could lead to significant tax implications.

In this post, we’ll delve into the difference between franked and unfranked dividends. We’ll also share easy-to-follow formulas and sample scenarios that will help small business owners like you make the most of your dividend approach.

What is a franking credit?

The tax paid by the company on your dividend is known as a Franking Credit. Simply put, it’s the tax the company has already paid on its earnings, which the shareholder can use to offset their own tax liability. This technical aspect prevents shareholders from facing double taxation.

Dividends, the profits distributed by a company to its shareholders, can be regular (quarterly, half-yearly, yearly) and are decided by the company’s board of directors. When a company pays a dividend to a shareholder, it can be a Franked Dividend (Partially or Fully Franked) or an Unfranked Dividend.

The terms ‘unfranked,’ ‘partially franked,’ and ‘fully franked’ refer to the amount of the dividend paid by the company after tax.

If you live in Australia and pay taxes, the dividends you receive are added to your taxable income and the tax implications depend on whether the dividend is franked or unfranked.

Is it better to have franked or unfranked dividends?

Franked dividends are better than unfranked dividends. With franked dividends, the company you own shares in has paid some of the tax on your behalf which will help reduce the tax you pay as a shareholder.

Franked Dividends

Franked dividends refer to dividends paid by an Australian resident company to its shareholders with a franking credit attached to it. Franking credits are used as a tax offset for shareholders when they calculate their income tax for a financial year. Franked dividends can either be:

- Fully Franked – where the whole amount of the dividend has a franking credit attached to it

- Partially Franked – where part of the dividend has a franking credit attached to it.

Franking Credit Formula

Franking credits on dividends received from large listed companies (typically over $50M in aggregated annual turnover such as ASX listed companies with a company tax rate of 30%) are calculated using the following formula:

Franking Credit = Dividend Amount x 30%/(70% x Franking Percentage)

If the Franking Percentage of the large company 100% (or in other words, fully franked), then the Franking Credit is simply:

Franking Credit = Dividend Amount x 30%/70%

Small businesses would apply the same formula as above, but would use the small business tax rate of 25% (rather than 30%).

Franked Dividend Example

Here’s an example of the tax implications for individual shareholders across three scenarios. It shows the benefit of a franked dividend for low, middle, and high income earners.

The example should illustrate the benefit of using franked dividends when considering the best tax planning options available to small businesses owners, particularly when the business owner has set up the ownership structure via a trust. Franked dividends through trusts to family members can be one of the most effective ways to minimise your tax when running a small business.

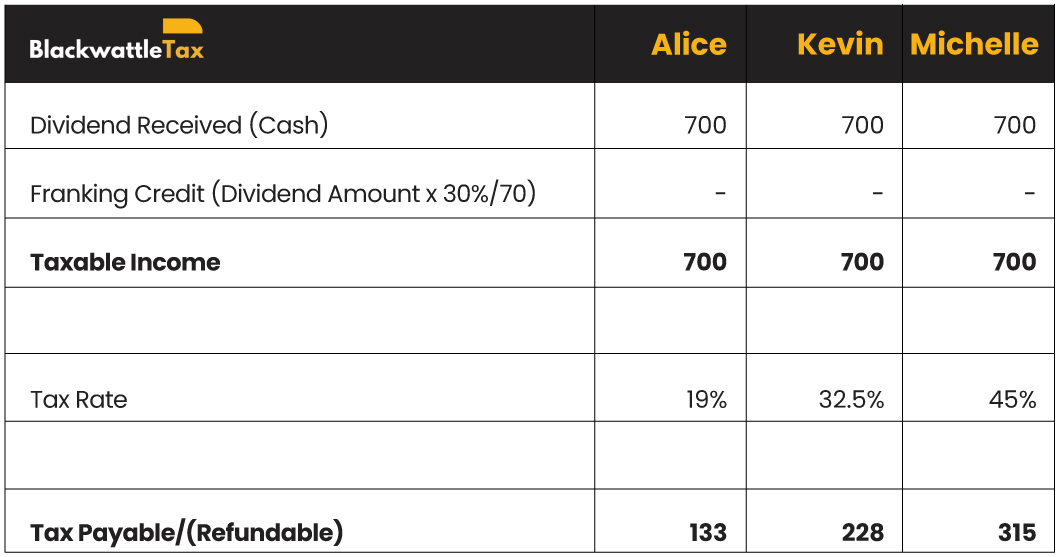

Alice, Kevin, and Michelle each receive a $700 fully franked dividend from an ASX Listed company, which had paid company tax on its profits at a rate of 30%. The franking percentage on the dividends is 100%. The marginal tax rates of Alice, Kevin and Michelle (excluding Medicare) are 19%, 32.5% and 45% respectively. The tax payables/refunds of Alice, Kevin and Michelle in relation to the dividends are as follows:

Unfranked Dividends

Unfranked dividends have not had any tax paid on them by an Australian resident company. Therefore, franking credits are not attached to unfranked dividends. Individual shareholders will have to pay tax on unfranked dividends received at their marginal tax rate as this type of dividend is simply added to the taxable income of the shareholder.

Using the same example above (with the exception of the dividends being unfranked instead of franked), the tax payables of Alice, Kevin and Michelle in relation to the unfranked dividends are as follows:

What do small business owners need to know about franked dividends?

It is important for everyone, whether you are a small business owner looking to minimise your tax from your profitable small business or an equities investor making sense of the tax implications for your share portfolio. Understanding how dividends and franking credits work is the first step to ensuring you maximise your tax benefits.

What is the best dividend strategy?

You may hear business owners and Tax Agents speak about tax planning. It is a vague industry term that can mean a lot of things to people. Ultimately, it is a formal (or informal) process of periodically reviewing tax implications for business owners and individuals based on their specific circumstances. That being said, dividend strategies are often a key component to good tax planning strategies.

The best dividend strategies consider several key factors that are specific to each individual business, family group, and individual tax position. Here are some things you need to keep in mind:

- First, you should complete the tax returns for all the business entities including companies, trusts, and partnerships.

- Then, you should look at the draft tax position of the individual or individuals across a family group. This is particularly important for operating businesses that involve several members of a family group.

- Next, you should look at the profit or loss positions of the businesses in the first step. This will help determine:

- If there are any profits that will allow a dividend to be paid to a shareholder/shareholders

- If the company has any available franking credits to pay a franked dividend

- You can then calculate a draft tax position based on various scenarios of paying dividends to a shareholder or shareholders. We suggest you run scenario calculations altering the amount of the dividend, the amount of franking credits available, and who in the family group they can be distributed to (particularly relevant if you have set up your shareholding in a tax efficient trust structure).

Note that the information provided above only serves as a handy and quick reference guide. Profits for small businesses may change year to year, frank credits available will go up and down, and an individual’s taxable positions may also depend on their personal income each year. Therefore, it is best consult a Registered Tax Agent or qualified Chartered Accountant to help you understand the available dividend strategies for tax planning each year.

Pro tip: Schedule a meeting with your accountant in April/May each year (well ahead of the 30 June end of the financial year) to plan the dividend strategies. This proactive approach allows you to collaboratively devise dividend strategies tailored to align with other essential tax planning decisions.

Need help with your dividend strategy? Connect with our experts at Blackwattle Tax.

As your reliable outsourced accounting team, our seasoned Chartered Accountants and tax agents are ready to guide business owners like you in maximising investments and tax benefits.

At Blackwattle Tax, we boast a track record of supporting diverse sectors, empowering clients to make informed decisions that lead to enhanced financial and tax outcomes.

Schedule a FREE 30-minute consultation today to discuss your investment goals, allowing us to assist you in crafting a customised business strategy.

Stay informed and empowered in your financial decisions by signing up for our monthly newsletter, offering valuable insights on business advice, investment tips, and tax planning strategies.

Disclaimer: We endeavour to make sure the information provided in this guidance is up to date and accurate. Please note, that the information is only intended to be a guide, with a general overview of information. This guidance is not a comprehensive document and should not be interpreted as legal advice or tax advice. The information is general in nature. You should seek the assistance of a professional opinion for any legal and tax issues related to your personal circumstances.