Imagine this scenario: You or your business decides to part ways with an asset – perhaps it’s a property or a piece of equipment. This transaction sets the stage for a potential capital gain or loss, representing the difference between the initial purchase price and the final selling price. We call this financial moment a CGT event. The CGT incurred becomes part of your income tax for the financial year when this event takes place.

In this guide, we aim to simplify how CGT works, making it accessible for you to comprehend and calculate the net capital gain or loss on your CGT assets.

What is capital gains tax (CGT)?

Capital Gains Tax (CGT) is the tax paid on profits from disposing of CGT assets, such as property, shares in a private business or listed company, business assets such as equipment or motor vehicles, and crypto. CGT is not a separate tax; it falls within income tax that is paid by individuals, companies, and superannuation funds. Some exemptions do apply in certain situations.

Generally speaking, you make a Capital Gain when the price that you sell your CGT asset for (Capital Proceeds) is greater than what you acquired the asset for (otherwise known as the Cost Base).

If the Cost Base is greater than the Capital Proceeds, then you have made a Capital Loss.

Capital losses can be used to offset current and future capital gains, however they cannot be used to offset other ordinary assessable income.

Who can claim the CGT discount?

Note the following specific CGT rules applicable to different entity types that dispose of CGT assets:

Individuals – entitled to a CGT discount of 50% of the capital gain if the CGT asset had been held for 12 months or more. The discounted capital gain is then taxed at the individual’s marginal tax rate.

Companies – not entitled to the 50% CGT discount and any capital gains are taxed at the company tax rate (25% for Base Rate Entities and 30% for other companies).

Superannuation Funds – the CGT discount for superannuation funds is 33.33% and the tax rate on capital gains is 15% if the superfund is in accumulation phase, reduced to 10% if the investment was owned for longer than 12 months. If the superfund is in the Pension Phase, the tax rate on capital gains is 0%.

Partnerships and Trusts – these entities typically are entitled to the 50% CGT discount, however they do not pay CGT. Any capital gains derived by these entities are distributed to Partners/Beneficiaries.

What are the types of CGT assets?

The following list contains the common types of CGT assets that are disposed of. In relation to calculating CGT on the disposal of these assets, it is advised that you contact your accountant for assistance as there are specific rules, reductions and exemptions depending on the CGT asset that is being disposed of:

- Investment properties

- Main residence properties

- Shares/Units

- Cryptocurrency

- Personal use assets, such as boats and furniture

- Collectables, such as artwork and jewellery

- Intangible assets, such as leases and goodwill

- Compensation and damages payouts

- Assets acquired before 20 September 1985

As mentioned earlier, when you dispose of a Capital Asset, it is called a CGT Event. If you sell an asset for less than you purchased it for, this constitutes a Capital Loss, and you won’t need to pay any tax on the event.

Take note that Capital Losses must be reported in your tax return to offset any future Capital Gains, but we’ll get to that later.

How is Capital Gains Tax calculated?

There are three (3) methods for calculating CGT.

- CGT discount method

- Indexation method

- The “other method”

CGT discount method

This method allows for 50% of a capital gain to be applied to the sale of a CGT asset if the asset has been held for 12 months or more by an Individual or Trust. The formula for an Individual/Trust that sells a CGT asset is as follows:

Capital Gain = Capital Proceeds (amount received on sale) less Cost Base (cost to acquire asset)

Net Capital Gain = Capital Gain (per above) less 50% of the Capital Gain

Note: the CGT discount for superfunds is 33.33%

Indexation Method

This method is the least common method to be used. It is mostly applied to assets that are acquired and held for a significant period.

To use this method, the relevant asset must be acquired before 11.45 am (ACT time) on 21 September 1999 and held for 12 months or more before the disposal of the assets. The formula is as follows:

Capital Gain = Capital Proceeds multiplied by Indexation Factor

(Indexation Factor = CPI for Quarter of CGT Event ÷ CPI for Quarter when Expenditure Occurred)

The Other Method

This method is used when the Discount Method and Indexation Method are not used by a taxpayer. It is typically used when an asset has not been held for 12 months or more. The formula is simply:

Net Capital Gain = Capital Proceeds less Cost Base

Simple example for calculating CGT

Below is a simple example to help you understand the basic steps to calculate CGT. This is done in four (4) basic steps:

- Determine your Cost Base: Cost Base is the terminology the ATO uses to describe how much you have paid for an asset, plus any fees or commissions on purchase. If you are selling a property, renovations, and other Capital Expenditure (i.e. expenses that can’t be claimed against income) will also need to be added to your Cost Base.

- Determine your realised amount: This is just how much you’ve sold the asset for, again, less any fees of commission on disposal.

- Calculate the difference: Subtract your Cost Base from your realised amount and determine the difference. If your Cost Base was greater than your realised amount, you have made a Capital Loss. If your Cost Base was less than your realised amount, you have made a Capital Gain.

- Calculate the tax on your capital gain: If you have made a Capital Gain, this gets added to your Taxable Income in your return, and the total amount is taxed are your nominal tax rate, i.e. standard tax brackets apply to any CGT events, they don’t have a dedicated tax rate.

The above methodology is applicable to all CGT events, but it’s worth noting that there are a couple other elements that can come into play.

Firstly, we’ve touched on it before, but in the event that you have made a capital loss, this loss will need to be reported in your tax return. In the event that you do make a gain in the future, it will offset this loss first, and the balance is what you’ll end up taxed on. If you do not consume all of the previous capital losses, you will need to continue reporting the balance of losses in your returns, until such a time where you make enough Capital Gains to offset the full amount.

Another factor to consider is that if you hold the asset for more than 12 months, the asset had been owned and disposed of by an individual (i.e. not a company), and you do end up making a Capital Gain, the ATO will allow you a discount of 50% on the gain.

As to say, if you have made a gross Capital Gain of $1,000, and you’ve held the disposed asset for more than a year, you will only need to report $500 of gain in your tax return, which then gets added to your assessable income.

The order of applying these rules is also important; The losses will need to offset the gross or pre-discount amount, and if the Capital Gain that tipped you out of a loss position was for an asset held for more than a year, you can then apply the discount to the net gain after using up your losses.

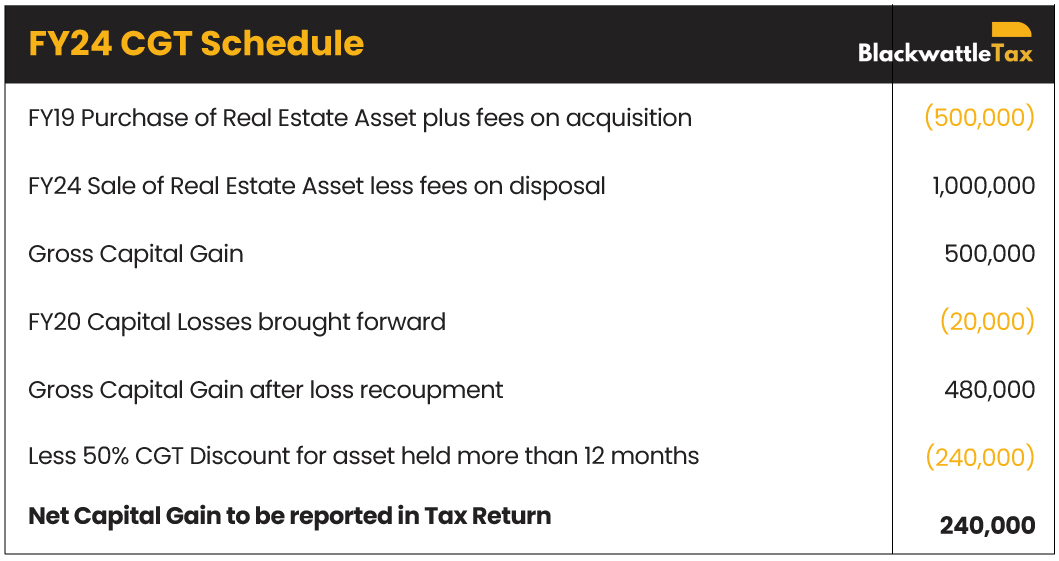

We’ve prepared an illustrative example below:

In the above example, even though our hypothetical client has sold a property for a million dollars, proper review and application of their circumstances means that they are only paying tax on a quarter of the initial capital gain.

It’s always important to get in touch with your Chartered Accountant to ensure that a thorough review of your matters has been conducted in ensuring that you’re not paying any more tax than you have to.

How can I reduce my CGT using CGT exemptions?

There are various CGT exemptions and reductions when you dispose of a CGT asset. As these exemptions require specific, complex criteria to be satisfied, it is advised that you contact your accountant to determine your eligibility to access them.

Small Business CGT Concessions

Capital gains that you make on the sale of a small business (or sale of shares/units in a small business) could be reduced by accessing the following small business CGT concessions:

- 15 year exemption

- The 50% active asset exemption

- Retirement exemption

- Rollover concession

Small Business Restructure Rollover (SBRR)

The SBRR provisions allow small businesses to transfer active assets from one entity to one or more other entities without incurring any CGT liabilities. The provisions are available if each party to the transfer is one of the following in the income year in which the transfer occurs:

- a small business entity

- an entity that has an affiliate that is a small business entity

- an entity that is connected with a small business entity

- a partner in a partnership that is a small business entity

There are three (3) further conditions that need to be satisfied in order to qualify for the SBRR provisions as follows:

- Part of a genuine restructure

- No change to ultimate economic ownership

- The asset transferred is an ‘Eligible Asset’

Main Residence Exemption

Australian tax residents can be exempt from CGT if they dispose of their main residence (a property) and:

- The property was used by them, their partner and their dependents;

- The property was not used for investment purpose (used to earn rent or renovating to sell at a property); and

- The property is on land of 2 hectares or less.

You may be able to access a partial main residence exemption if not all the criteria above are met.

Relationship Breakdown Rollover

This rollover allows for CGT deferred when there are assets transfers between two people who separate or divorce. CGT will apply to the person who received the asset when they later dispose of it. In other words, CGT will not be avoided, it will deferred to a later date.

This rollover only applies if assets are transferred under a court order or another formal agreement and the relevant individuals must use it if the rollover applies to the relevant assets.

Scrip-for-Scrip Rollover

Scrip for scrip roll-over relief is generally available where shares in one company (the target company) are replaced with shares in another company (the takeover company) where at least 80% of the shares in the target company are owned by the takeover company.

If this rollover applies, any capital gain which would otherwise be made on the transfer of the shares would be disregarded and will be deferred until the interest in the takeover company is disposed of.

Seeking expert guidance for calculating your capital gains tax? Connect with our team at Blackwattle Tax.

Managing Capital Gains Tax (CGT) depends heavily on your individual circumstances. At Blackwattle Tax, our dedicated team is prepared to assist you with a personalised strategy, utilising available provisions to minimise potential capital gains tax.

We strongly advise consulting with your Chartered Accountant or Registered Tax Agent before selling, ensuring a thorough review of steps, precautions, and opportunities to optimise your tax outcome, given the limited options available post-CGT events.

At Blackwattle Tax, our proven track record spans diverse sectors, empowering clients with informed decisions for superior financial and tax results.

Schedule a FREE 30-minute consultation today to discover how we can enhance your tax planning and investment decisions.

Stay informed and empowered by subscribing to our monthly newsletter, delivering valuable insights on business advice, investment tips, and strategic tax planning.

Disclaimer: We endeavour to make sure the information provided in this guidance is up to date and accurate. Please note, that the information is only intended to be a guide, with a general overview of information. This guidance is not a comprehensive document and should not be interpreted as legal advice or tax advice. The information is general in nature. You should seek the assistance of a professional opinion for any legal and tax issues related to your personal circumstances.